Lifestyle Habits and Routines to Master Your Finances

Mastering your finances is a journey that can be seamlessly integrated into your daily lifestyle. By incorporating smart financial habits, you can achieve financial stability and peace of mind without feeling overwhelmed. Here are some expanded and detailed lifestyle-focused habits and routines to help you master your finances:

1. Adopt a Minimalist Lifestyle

Embracing minimalism can significantly reduce unnecessary expenses and clutter. Focus on owning fewer, higher-quality items that serve multiple purposes. This approach can lead to more mindful spending and a clutter-free environment.

Action Step:

- Declutter Regularly: Go through your belongings and sell or donate items you no longer need. This not only simplifies your living space but can also generate extra cash. Consider using online platforms like eBay, Craigslist, or local consignment shops.

- Invest in Quality: Prioritize purchasing high-quality, durable items that you genuinely need and that will last longer. This reduces the need for frequent replacements and repairs.

2. Plan Your Meals

Frequent dining out can be a significant drain on your finances. By planning your meals and cooking at home, you can save money and eat healthier. Meal planning can also help reduce food waste.

Action Step:

- Weekly Meal Planning: Create a meal plan for the week and make a grocery list based on that plan. Prep meals in advance to save time and avoid the temptation of takeout.

- Batch Cooking: Cook large portions and freeze meals for later use. This can save time and money, especially on busy days when you're tempted to order takeout.

3. Practice Mindful Spending

Mindful spending involves being intentional with your purchases, ensuring that your spending aligns with your values and financial goals. It’s about making conscious decisions rather than impulsive buys.

Action Step:

- Evaluate Purchases: Before making a purchase, ask yourself if it's necessary and if it adds value to your life. Implement a 24-hour rule for non-essential purchases to avoid impulsive decisions.

- Track Your Spending: Use apps like Mint or YNAB (You Need a Budget) to track your expenses and categorize your spending. This helps you identify areas where you can cut back.

4. Incorporate Exercise into Your Routine

Maintaining good health can prevent costly medical bills in the future. Regular exercise is a cost-effective way to stay healthy and avoid the expenses associated with poor health.

Action Step:

- Find Free or Low-Cost Activities: Utilize free resources like online workout videos, local parks, or community sports groups. Walking, jogging, and biking are also excellent and inexpensive ways to stay active.

- Set a Routine: Schedule regular exercise sessions into your daily or weekly routine. Consistency is key to reaping the health benefits of exercise.

5. Utilize Public Transportation or Carpool

Transportation can be a significant expense. By using public transportation or carpooling, you can save on fuel, maintenance, and parking costs.

Action Step:

- Plan Your Routes: Use public transportation apps to plan your trips efficiently. Explore discounts or passes offered by public transit systems to save more.

- Carpool: Set up a carpool with colleagues or neighbors to share commuting costs. Websites like BlaBlaCar or local carpooling apps can help you find carpool partners.

6. Grow Your Own Food

Starting a small garden can be both a relaxing hobby and a way to reduce your grocery bill. Fresh herbs, vegetables, and fruits from your garden can supplement your meals.

Action Step:

- Start Small: Begin with easy-to-grow plants like herbs, tomatoes, and lettuce. Use containers if you have limited space.

- Learn Gardening Skills: Use resources like gardening books, online tutorials, or community gardening classes to improve your skills and expand your garden over time.

7. Embrace DIY Projects

Doing things yourself, whether it’s home repairs, gifts, or decorations, can save money and give you a sense of accomplishment. DIY projects can also be a fun and creative outlet.

Action Step:

- Learn Basic Skills: Start with small projects and gradually take on more complex ones as you build your skills. Online platforms like YouTube and DIY blogs offer tutorials for various projects.

- Use Quality Tools: Invest in a basic set of quality tools that will last and serve multiple purposes.

8. Prioritize Experiences Over Material Goods

Spending on experiences rather than material goods often leads to greater happiness and less financial clutter. Travel, hobbies, and time with loved ones provide lasting satisfaction and memories.

Action Step:

- Budget for Experiences: Allocate a portion of your budget to experiences such as travel, concerts, or classes. These activities can enrich your life and create lasting memories.

- Seek Free or Low-Cost Experiences: Look for community events, free museum days, or outdoor activities that offer enriching experiences without high costs.

9. Build a Capsule Wardrobe

A capsule wardrobe consists of a limited number of versatile clothing items that you love and wear frequently. This can simplify your life and reduce clothing expenses.

Action Step:

- Curate Your Wardrobe: Assess your current wardrobe and keep only the items you wear regularly. Donate or sell items that no longer fit or suit your style.

- Invest in Timeless Pieces: Choose high-quality, timeless pieces that can be mixed and matched to create multiple outfits. This reduces the need for frequent shopping.

10. Participate in Community Activities

Engaging in community activities can provide free or low-cost entertainment and a sense of belonging, reducing the need for expensive outings.

Action Step:

- Explore Local Events: Check local listings for community events such as free concerts, farmers' markets, and workshops. Participate in volunteer opportunities that interest you.

- Join Clubs or Groups: Look for clubs or groups that align with your interests. This can be a great way to meet new people and engage in activities you enjoy.

Estimated Monthly Savings by Adopting Financial Habits:

- This bar chart shows the estimated monthly savings for each habit. The data highlights how each habit can contribute to overall financial savings.

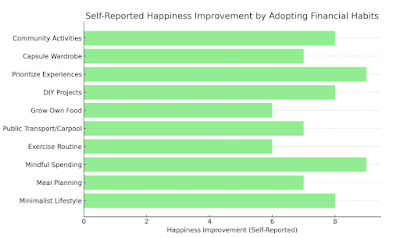

Self-Reported Happiness Improvement by Adopting Financial Habits:

- This bar chart illustrates the self-reported happiness improvement associated with each habit. It underscores the potential emotional and psychological benefits of incorporating these habits into daily life.

By integrating these habits, individuals can not only improve their financial health but also enhance their overall well-being.

Estimated Monthly Savings by Adopting Financial Habits:

- This bar chart shows the estimated monthly savings for each habit. The data highlights how each habit can contribute to overall financial savings.

Self-Reported Happiness Improvement by Adopting Financial Habits:

- This bar chart illustrates the self-reported happiness improvement associated with each habit. It underscores the potential emotional and psychological benefits of incorporating these habits into daily life.

By integrating these habits, individuals can not only improve their financial health but also enhance their overall well-being.

Proverb to Ponder

"The best things in life are free." – This timeless proverb reminds us that joy and satisfaction often come from experiences and relationships rather than material possessions. Embracing a lifestyle that values simplicity and mindfulness can lead to both financial stability and personal fulfillment.

By incorporating these expanded lifestyle habits and routines, you can create a balanced and financially healthy life. These practices not only help you save money but also enhance your overall well-being and happiness.

Use the tool below to find more articles on this

Comments

Post a Comment