Daily Habits and Routines to Master Your Finances

Introduction

Achieving financial stability is often about implementing consistent, small changes in your daily habits. This guide explores various routines that can help you manage your finances more effectively.

1. Plan Your Meals and Cook at Home

Benefits of Cooking at Home

Cooking at home is a cost-effective way to ensure healthier eating habits. Dining out or ordering takeout regularly can be expensive and often less nutritious. By planning your meals, you can control the ingredients and portion sizes, leading to better health and financial savings.

Meal Planning Tips

- Weekly Planning: Dedicate time each week to plan your meals. Write down your breakfast, lunch, and dinner for each day. Create a grocery list based on your meal plan to avoid unnecessary purchases.

- Batch Cooking: Prepare large portions of meals and store them in the fridge or freezer. This practice saves time and ensures you always have a home-cooked meal available.

Proverb

“A penny saved is a penny earned.”

Activity

Create a weekly meal plan and list all the ingredients needed. Compare this cost with your previous week's spending on dining out. This exercise will highlight the financial benefits of cooking at home.

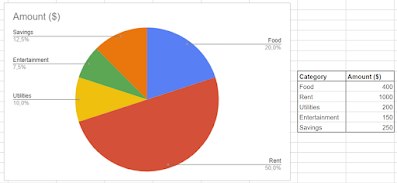

2. Track Your Spending Daily

Use a Budgeting App

Budgeting apps help track every expense, regardless of size. These apps can categorize your spending, show trends, and alert you when you’re overspending.

Review and Adjust

Allocate time each week to review your spending. Analyze your expenses to identify areas where you can cut back. Adjust your budget to ensure adequate savings and avoid overspending in any category.

Proverb

“Take care of the pennies and the pounds will take care of themselves.”

Activity

Download a budgeting app and track all your expenses for a month. At the end of the month, review your spending to identify areas for improvement. This practice enhances awareness of your spending habits.

3. Smart Decision-Making: Buy vs. Repair

Cost-Benefit Analysis

When something breaks, consider whether to repair it or buy a new one. Conduct a cost-benefit analysis to compare the expenses and benefits of both options. If repairing costs less than half of a new item and significantly extends its life, it might be worth repairing.

Long-Term Savings

Repairs might seem costly upfront but can save money over time compared to frequent replacements. For instance, repairing a washing machine can be more economical than purchasing a new one.

Proverb

“A stitch in time saves nine.”

Activity

List items you typically replace and consider if repairs could be a more cost-effective option. Research repair costs versus replacement costs to make informed decisions.

4. Automate Your Savings

Automatic Transfers

Set up automatic transfers from your checking account to your savings account. This practice ensures regular saving without the need for constant reminders.

Emergency Fund

An emergency fund is money set aside for unexpected expenses like medical bills or car repairs. Aim to save three to six months' worth of living expenses in an easily accessible account.

Proverb

“Out of sight, out of mind.”

Activity

Set up an automatic transfer for a portion of your paycheck to go directly into your savings account. This habit makes saving money a seamless process.

5. Involve Your Partner

Joint Financial Goals

Discuss and set financial goals with your partner. These goals can include saving for a house, a vacation, or retirement. Collaborating ensures both partners are aligned and committed to achieving these goals.

Financial Discussions

Schedule regular meetings to discuss your financial situation, goals, and necessary adjustments. Transparent communication is vital for a healthy financial partnership.

Learning Together

Read financial books, attend workshops, or take online courses together to enhance your financial literacy. This shared learning helps both partners make informed decisions.

Proverb

“Two heads are better than one.”

Activity

Set a monthly financial meeting with your partner to review your budget and financial goals. This habit promotes communication and collaboration.

6. Limit Impulse Purchases

Wait Before Buying

Implement a 24-hour rule for non-essential purchases. If you still want the item after 24 hours, consider buying it. This waiting period helps you determine if the purchase is necessary.

Budget for Fun

Allocate a specific amount in your budget for discretionary spending. This allows you to enjoy occasional splurges without guilt or derailing your financial plan.

Proverb

“Look before you leap.”

Activity

Keep a list of items you want to buy and wait 24 hours before making a purchase. Track how many items you decide not to buy after the waiting period. This practice helps avoid unnecessary spending.

7. Utilize Free Resources

Library and Online Courses

Take advantage of free resources such as books from the library and online courses to improve your financial knowledge. Libraries offer a wealth of information, including personal finance books and access to financial education platforms.

Community Workshops

Many communities offer free workshops on personal finance. These workshops provide valuable opportunities to learn and ask questions from financial experts.

Proverb

“The best things in life are free.”

Activity

Find and enroll in a free online personal finance course or attend a local workshop. This practice helps you gain knowledge without spending money.

8. Regular Financial Health Checks

Monthly Reviews

Regularly review your budget, savings, and investments. This practice helps you stay on track and make necessary adjustments. Monthly reviews ensure your financial plan aligns with your current situation and goals.

Adjustments

Be flexible and willing to adjust your financial plan based on changes in your income, expenses, or financial goals. Life changes, and so should your financial plan.

Proverb

“An ounce of prevention is worth a pound of cure.”

Activity

Set a monthly reminder to review your financial health and make any necessary adjustments. This habit ensures you stay proactive in managing your finances.

Conclusion

Integrating these daily habits and routines into your life can significantly improve your financial health. Small, consistent actions can lead to substantial long-term benefits.

Final Proverb

“Slow and steady wins the race.”

By following these strategies, you can achieve greater financial stability and peace of mind.

Use the tool below to find more articles on this

Comments

Post a Comment