How to Protect Your Assets from a Potential Divorce

Divorce can be emotionally and financially challenging. Protecting your assets beforehand can help mitigate some of the financial stress. Here are several strategies to consider:

1. Prenuptial Agreements

A prenuptial agreement, signed before marriage, clearly defines the distribution of assets in the event of a divorce. This legal document can protect individual assets and set terms for spousal support. Prenups are particularly useful for individuals with significant pre-marital assets or those entering a second marriage.

2. Postnuptial Agreements

Similar to a prenuptial agreement, a postnuptial agreement is signed after marriage. It can address financial changes that occur during the marriage and outline asset distribution. Postnuptial agreements can be beneficial if significant assets are acquired during the marriage or if financial circumstances change substantially.

3. Keep Assets Separate

Maintain separate accounts and property to keep them distinct from marital assets. Avoid commingling personal and marital funds, as this can complicate asset division. For instance, inheritances or gifts can remain separate if they are not deposited into joint accounts or used for joint purchases.

4. Establish Trusts

Setting up a trust can protect assets from being considered marital property. Irrevocable trusts, where you relinquish control of the assets, can be particularly effective. Trusts can provide for children or other beneficiaries without transferring ownership directly, safeguarding the assets from divorce proceedings.

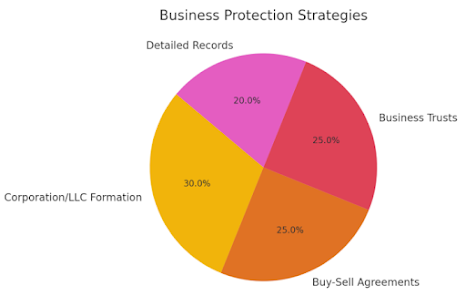

5. Business Protection

If you own a business, consider strategies such as forming a corporation or LLC, drafting a buy-sell agreement, or establishing a trust for the business. Keep detailed records and avoid using business funds for personal expenses. This separation can prevent the business from being considered marital property.

6. Insurance Policies

Life insurance, disability insurance, and long-term care insurance can provide financial stability and protect assets. Naming children or trusts as beneficiaries can help ensure the assets are protected. These policies can serve as a financial cushion, providing security to dependents regardless of marital status.

7. Legal and Financial Advice

Consult with legal and financial advisors who specialize in asset protection and family law. They can provide personalized strategies based on your specific situation and jurisdiction. Professional guidance ensures that your asset protection strategies are legally sound and effectively implemented.

8. Keep Detailed Records

Maintain detailed records of all assets, including their value at the time of marriage and any appreciation or depreciation. Documentation can be crucial in proving the nature and value of assets. Accurate records help establish which assets are marital property and which are separate, simplifying asset division.

9. Monitor Financial Accounts

Regularly monitor joint financial accounts to ensure transparency and detect any unusual activity. Being proactive can prevent financial surprises during divorce proceedings. Keeping an eye on accounts helps identify any suspicious withdrawals or transfers that could impact asset division.

10. Consider Estate Planning

Updating your estate plan, including wills and powers of attorney, can ensure your assets are distributed according to your wishes, regardless of marital status changes. Estate planning can also involve setting up trusts and other structures to protect assets for future generations.

Step-by-Step Process for Establishing a Prenuptial Agreement:

Discuss with Your Partner:

- Have an open and honest conversation about the importance of a prenuptial agreement and how it can protect both parties' assets.

Consult Legal Advisors:

- Each party should hire their own attorney to ensure that the agreement is fair and legally binding. Choose attorneys who specialize in family law.

List All Assets and Debts:

- Create a comprehensive list of all assets and debts owned by each party. This should include property, bank accounts, investments, and any liabilities.

Draft the Agreement:

- Work with your attorneys to draft the prenuptial agreement. Ensure it clearly outlines the division of assets and debts in the event of a divorce.

Review and Negotiate:

- Review the draft agreement with your partner and attorneys. Make any necessary changes to ensure that both parties agree on the terms.

Sign and Notarize:

- Once the agreement is finalized, both parties should sign it in the presence of a notary public to ensure it is legally binding.

Proverb:

"An ounce of prevention is worth a pound of cure."

This proverb highlights the importance of taking preventive measures, like establishing a prenuptial agreement, to protect against potential future problems.

Conclusion

Proactively protecting your assets requires careful planning and legal guidance. While no strategy can guarantee complete protection, taking these steps can significantly reduce financial vulnerability in the event of a divorce. Always seek professional advice tailored to your unique circumstances to ensure the best possible outcome.

Use the tool below to find more articles on this.

Comments

Post a Comment