How to Get Out of Student Debt: A Step-by-Step Guide

Student debt can be a significant burden, impacting your financial well-being and future plans. However, with the right strategies and determination, you can effectively manage and eliminate your student debt. Here’s a comprehensive guide to help you get out of student debt and achieve financial freedom.

1. Understand Your Debt

a. Identify Your Loans

Start by listing all your student loans, including the lender, loan balance, interest rate, and repayment terms. This includes both federal and private loans.

b. Know Your Loan Types

Understand the difference between federal and private student loans. Federal loans often offer more flexible repayment options and protections compared to private loans.

c. Check Your Loan Status

Keep track of the status of each loan, including whether it’s in grace, repayment, deferment, or forbearance.

2. Create a Budget

a. Track Your Income and Expenses

List all your sources of income and monthly expenses to get a clear picture of your financial situation. Categorize your expenses to identify areas where you can cut back.

b. Allocate Funds for Debt Repayment

Set aside a specific amount each month for student loan repayment. Ensure this amount is sustainable and fits within your overall budget.

3. Explore Repayment Options

a. Standard Repayment Plan

The default repayment plan for federal student loans, which involves fixed monthly payments over 10 years. This plan can save you money on interest compared to extended plans.

b. Income-Driven Repayment Plans

Federal student loans offer income-driven repayment (IDR) plans that base your monthly payment on your income and family size. These include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

c. Graduated Repayment Plan

This plan starts with lower payments that gradually increase every two years. It can be beneficial if you expect your income to increase over time.

d. Extended Repayment Plan

Allows you to extend your repayment term up to 25 years, which lowers your monthly payments but increases the total interest paid over the life of the loan.

4. Consider Loan Forgiveness Programs

a. Public Service Loan Forgiveness (PSLF)

If you work in a qualifying public service job and make 120 qualifying payments under an IDR plan, you may be eligible for loan forgiveness.

b. Teacher Loan Forgiveness

Teachers who work in low-income schools for five consecutive years may qualify for forgiveness of up to $17,500 on federal Direct and Stafford Loans.

c. Other Forgiveness Programs

Certain professions, such as healthcare workers and lawyers, may have specific loan forgiveness programs available.

5. Refinance or Consolidate Loans

a. Loan Refinancing

Refinancing involves taking out a new loan with a lower interest rate to pay off your existing loans. This can save you money on interest and lower your monthly payments. Note that refinancing federal loans with a private lender will result in the loss of federal protections and benefits.

b. Loan Consolidation

Federal loan consolidation combines multiple federal loans into one loan with a single monthly payment. While this can simplify repayment, it may not lower your interest rate.

6. Make Extra Payments

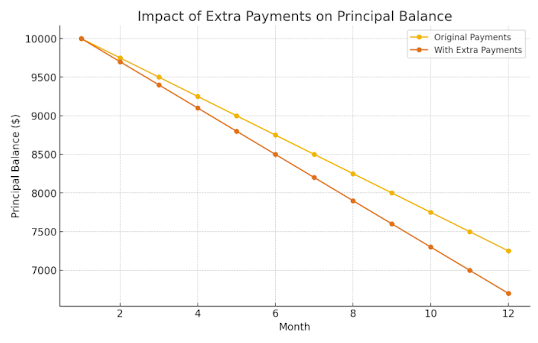

a. Pay More Than the Minimum

Whenever possible, pay more than the minimum monthly payment. This reduces the principal balance faster and saves you money on interest.

b. Apply Windfalls to Your Debt

Use bonuses, tax refunds, or any unexpected windfalls to make extra payments on your student loans.

7. Reduce Expenses and Increase Income

a. Cut Unnecessary Expenses

Review your budget to identify non-essential expenses you can eliminate or reduce. Consider cooking at home, canceling unused subscriptions, and finding cheaper alternatives for entertainment.

b. Increase Your Income

Take on a part-time job, freelance work, or side gigs to boost your income. Use the additional earnings to pay down your student debt.

8. Seek Employer Assistance

a. Employer Repayment Programs

Some employers offer student loan repayment assistance as part of their benefits package. Check with your employer to see if this benefit is available.

b. Negotiate for Assistance

If your employer doesn’t offer repayment assistance, consider negotiating this benefit during your job offer or performance review.

9. Stay Motivated and Monitor Progress

a. Set Milestones

Break down your debt repayment goal into smaller milestones. Celebrate each milestone achieved to stay motivated.

b. Use a Debt Tracker

Keep track of your repayment progress with a debt tracking tool or app. Seeing your progress can encourage you to stay on course.

c. Join Support Groups

Connect with others who are also working to pay off student debt. Share experiences, tips, and encouragement.

Step-by-Step Process for Creating a Budget:

List All Sources of Income:

- Write down all your sources of income, including salary, side jobs, and any other sources of revenue.

Track All Expenses:

- Record your monthly expenses, including rent, utilities, groceries, transportation, and entertainment.

Categorize Expenses:

- Divide your expenses into categories: fixed (e.g., rent), variable (e.g., groceries), and discretionary (e.g., dining out).

Identify Areas to Cut Back:

- Review your spending categories and identify areas where you can reduce expenses. Look for non-essential items that can be minimized or eliminated.

Set a Monthly Debt Repayment Goal:

- Determine a specific amount to allocate towards your student debt each month. Ensure this amount is sustainable within your overall budget.

Automate Payments:

- Set up automatic payments for your student loans to ensure you never miss a payment and to stay consistent with your repayment plan.

Monitor and Adjust:

- Regularly review your budget and spending habits. Adjust your budget as needed to stay on track with your debt repayment goals.

Proverb:

"Debt is the worst poverty."

This proverb emphasizes the burden that debt can impose and highlights the importance of managing and eliminating debt to achieve financial freedom.

Conclusion

Getting out of student debt requires a combination of strategic planning, disciplined budgeting, and proactive repayment. By understanding your debt, exploring repayment options, cutting expenses, and increasing your income, you can effectively manage and eliminate your student debt. Stay committed to your plan, and you’ll achieve financial freedom and peace of mind.

Use the tool below to find more articles on this.

Comments

Post a Comment