10 Essential Budgeting Tips for Financial Success

10 Essential Budgeting Tips for Financial Success

Managing your finances effectively is crucial for long-term financial success. Budgeting is one of the most important skills you can develop to ensure you are living within your means and saving for the future. Here are ten essential budgeting tips that can help you achieve financial stability and success.

Summary:

- Track Your Expenses

- Categorize Your Spending

- Set Realistic Goals

- Create a Savings Plan

- Prioritize Debt Repayment

- Use the 50/30/20 Rule

- Review and Adjust Your Budget Regularly

- Cut Unnecessary Expenses

- Plan for Irregular Expenses

- Stay Disciplined and Be Patient

- Step-by-Step Process for Using the 50/30/20 Rule

- Proverb

- Conclusion

1. Track Your Expenses

The first step in creating a budget is to understand where your money is going. Track all your expenses for a month, including small purchases. This will give you a clear picture of your spending habits and areas where you can cut back.

2. Categorize Your Spending

Divide your expenses into categories such as housing, groceries, transportation, entertainment, and savings. This will help you see which areas consume most of your income and where adjustments can be made.

3. Set Realistic Goals

Set both short-term and long-term financial goals. Short-term goals could include saving for a vacation or paying off a credit card, while long-term goals might involve saving for a down payment on a house or retirement. Having clear goals will motivate you to stick to your budget.

4. Create a Savings Plan

Make saving a priority by including it in your budget. Aim to save at least 20% of your income each month. If that’s not feasible, start with a smaller amount and gradually increase it. Consider setting up automatic transfers to your savings account to make the process easier.

5. Prioritize Debt Repayment

High-interest debt, such as credit card debt, can quickly spiral out of control. Prioritize paying off these debts as quickly as possible. Allocate a portion of your budget specifically for debt repayment and stick to it until your debts are cleared.

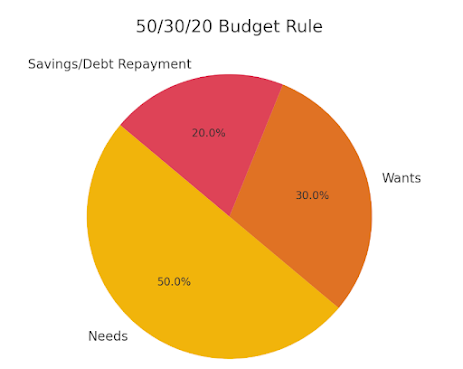

6. Use the 50/30/20 Rule

A popular budgeting method is the 50/30/20 rule. Allocate 50% of your income to needs (housing, utilities, groceries), 30% to wants (dining out, entertainment), and 20% to savings and debt repayment. This rule provides a balanced approach to managing your finances.

7. Review and Adjust Your Budget Regularly

Your financial situation and priorities may change over time, so it’s important to review and adjust your budget regularly. Set aside time each month to evaluate your budget and make necessary adjustments to stay on track with your goals.

8. Cut Unnecessary Expenses

Identify and eliminate unnecessary expenses. This could mean canceling unused subscriptions, cooking at home instead of dining out, or finding cheaper alternatives for everyday items. Cutting back on these small expenses can add up to significant savings over time.

9. Plan for Irregular Expenses

Irregular expenses, such as car repairs, medical bills, or holiday gifts, can derail your budget if you're not prepared. Set aside a small amount each month in a separate savings account to cover these unexpected costs.

10. Stay Disciplined and Be Patient

Budgeting requires discipline and patience. It may take time to see significant progress, but staying committed to your budget will pay off in the long run. Celebrate small victories along the way to stay motivated.

Step-by-Step Process for Using the 50/30/20 Rule:

Calculate Your After-Tax Income:

- Determine your total monthly income after taxes and deductions. This is the amount you have available to budget.

Divide Your Income:

- Allocate 50% of your income to needs (housing, utilities, groceries).

- Allocate 30% to wants (dining out, entertainment).

- Allocate 20% to savings and debt repayment.

Track Your Expenses:

- Use a budgeting app or spreadsheet to track all your expenses and ensure they fall into the appropriate categories.

Adjust and Refine:

- Regularly review your budget and make adjustments as needed to stay within the 50/30/20 allocation.

Automate Savings:

- Set up automatic transfers to your savings account to ensure the 20% savings allocation is consistently met.

Proverb:

"Failing to plan is planning to fail."

This proverb emphasizes the importance of having a structured budget plan to achieve financial success.

Conclusion

Effective budgeting is the foundation of financial success. By tracking your expenses, setting realistic goals, and prioritizing savings and debt repayment, you can take control of your finances and build a secure financial future. Remember, the key to successful budgeting is consistency and regular review. Start implementing these budgeting tips today and watch your financial health improve over time.

Use the tool below to find more articles on this.

Comments

Post a Comment